Lisa Ly,

Senior Product Designer

Home

Kookaburra

Electricity trading application optimised for large scale battery bidding.

Client

Origin Energy

Services

Systems

Strategy

Research

Industries

Energy Markets

Role

Lead Product Designer

Team Makeup

1 x Delivery Manager, 3 x Analysts, 5 x Developers, 2 x Testers, 1 x Designer

Date

April 2024 - Ongoing

Project has been renamed and images reproduced for privacy reasons.

Context & Problem

Origin Energy is expanding its renewable energy portfolio and identified the need for a new trading platform. It must be trader-centric in design and optimised to bid batteries into the market.

As the first design hire in Wholesale, I led the design strategy whilst highlighting design's critical role in internal wholesale projects.

Users & Environment

Key users consist of spot traders and strategy traders. With trading and compliance management as secondary users.

Traders currently navigate fast-paced, high-stakes markets characterised by unpredictability and swift settlements. Continuous focus on complex data make compliant bidding difficult.

Example of trading desk. Source: Google

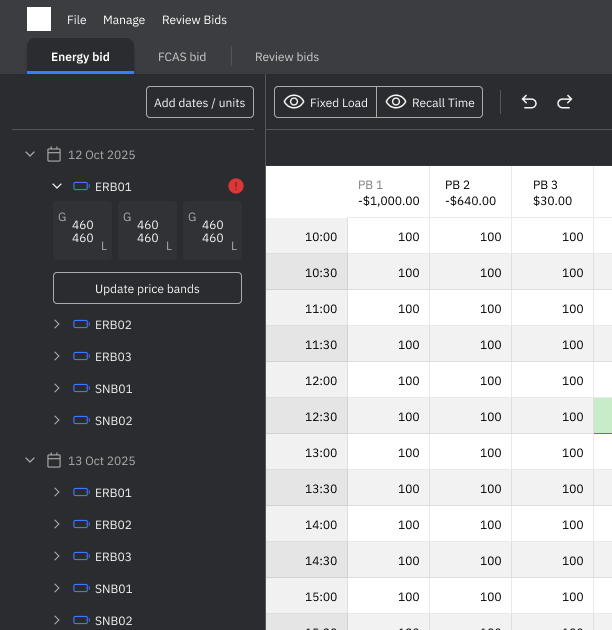

Final design

The final design brings together speed, clarity, and trader-centred decision making. The (ever-evolving) solution balances familiar mental models with new capabilities that support Origin’s first-ever battery bidding operations.

Key features

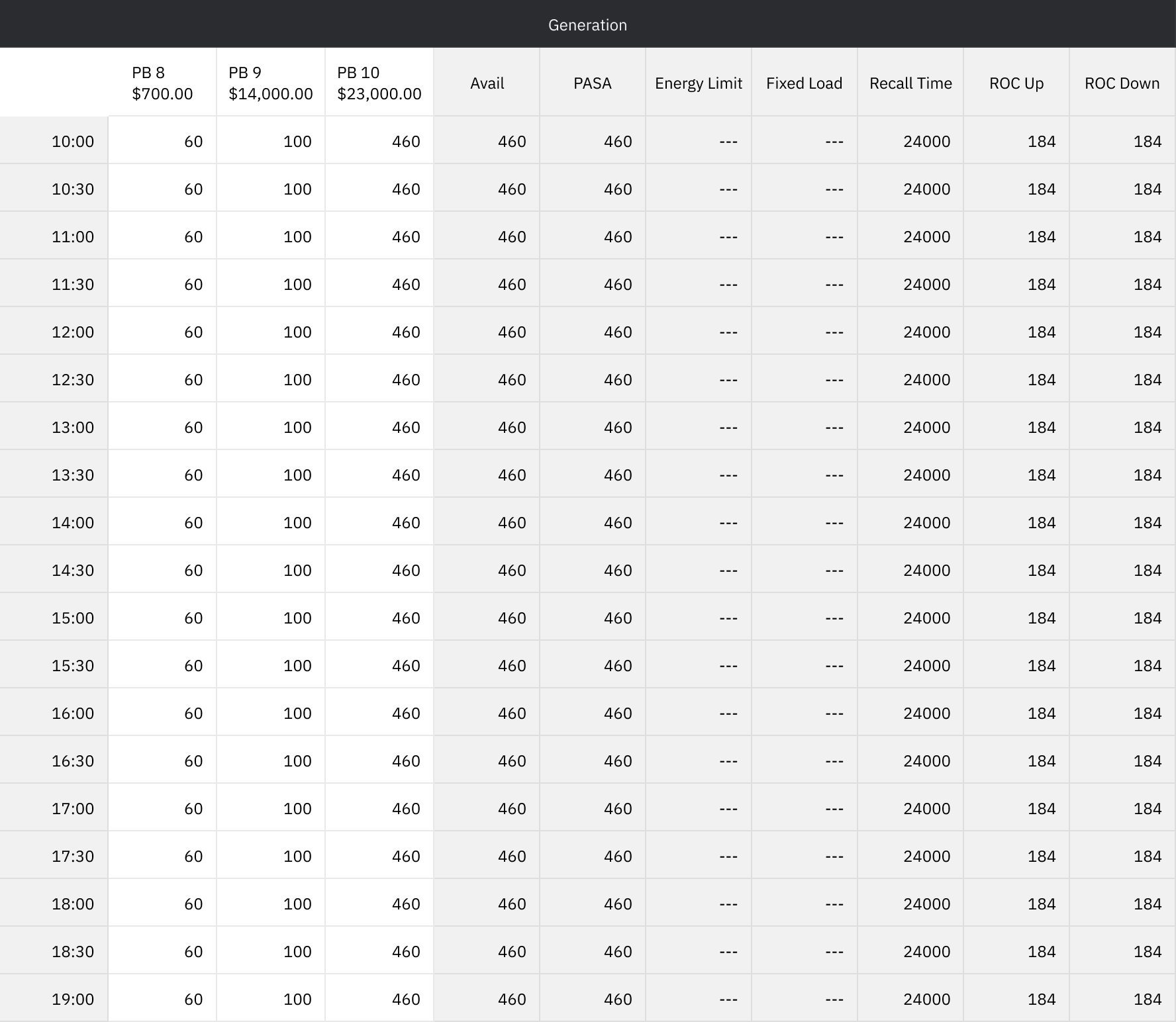

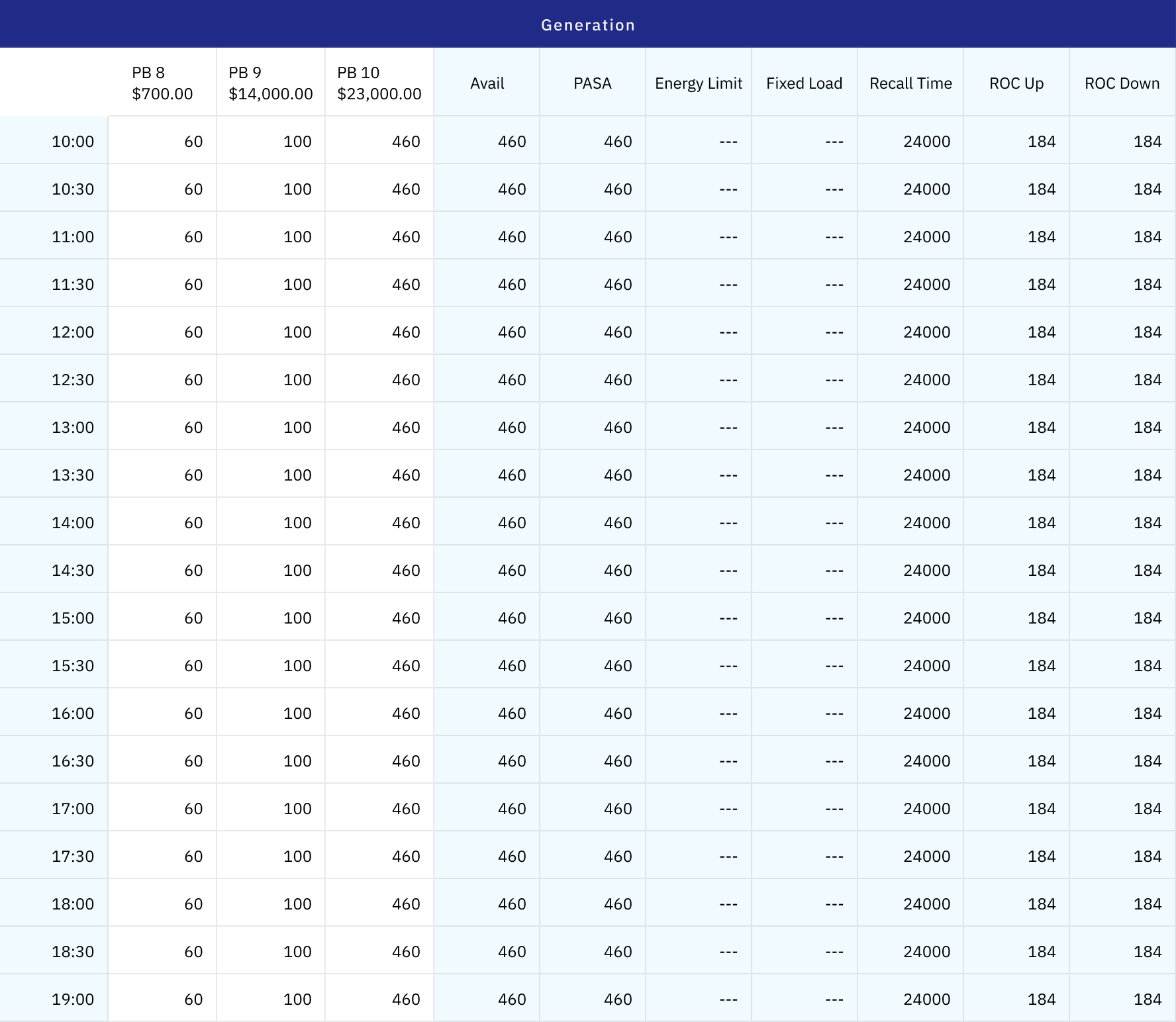

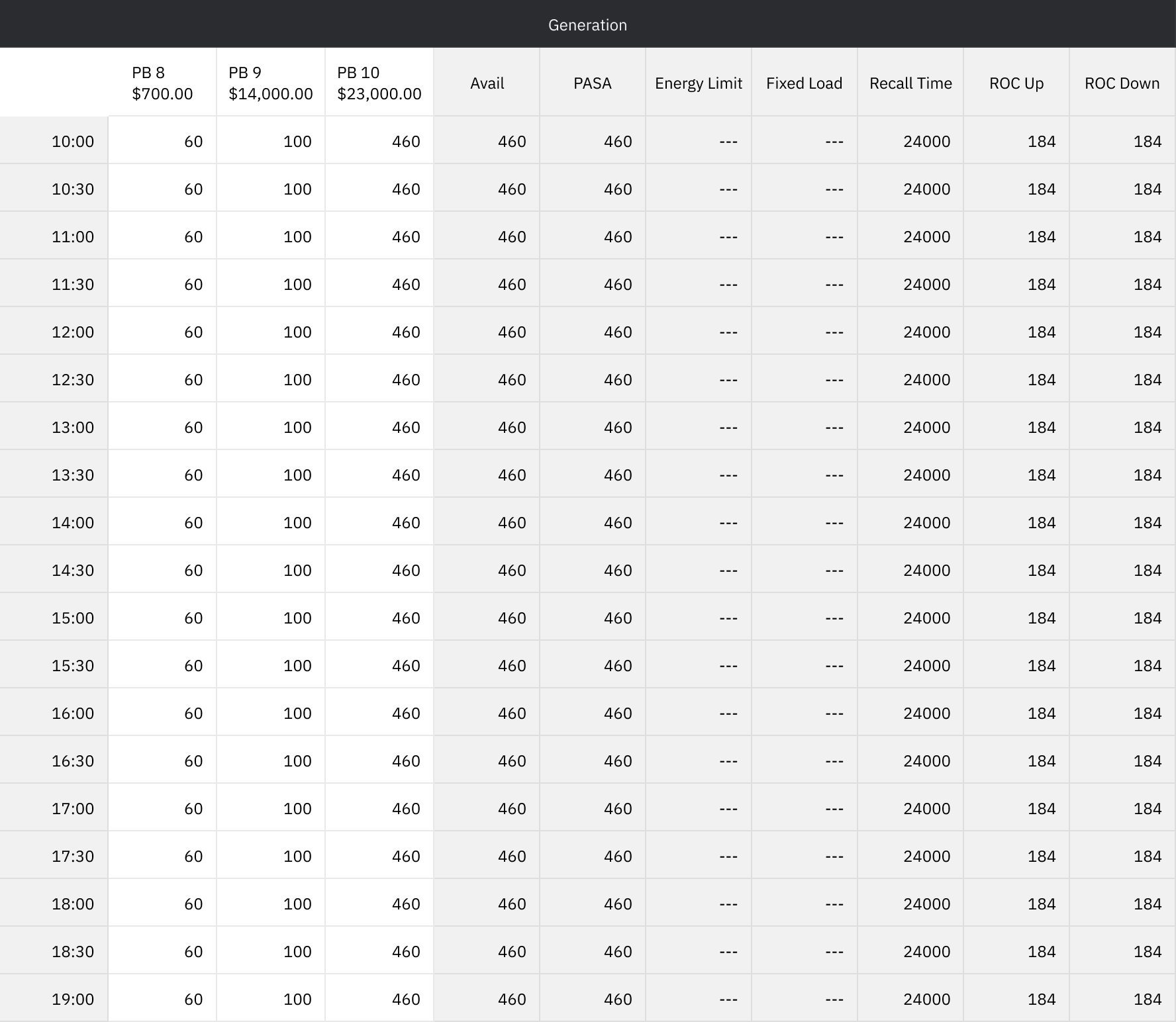

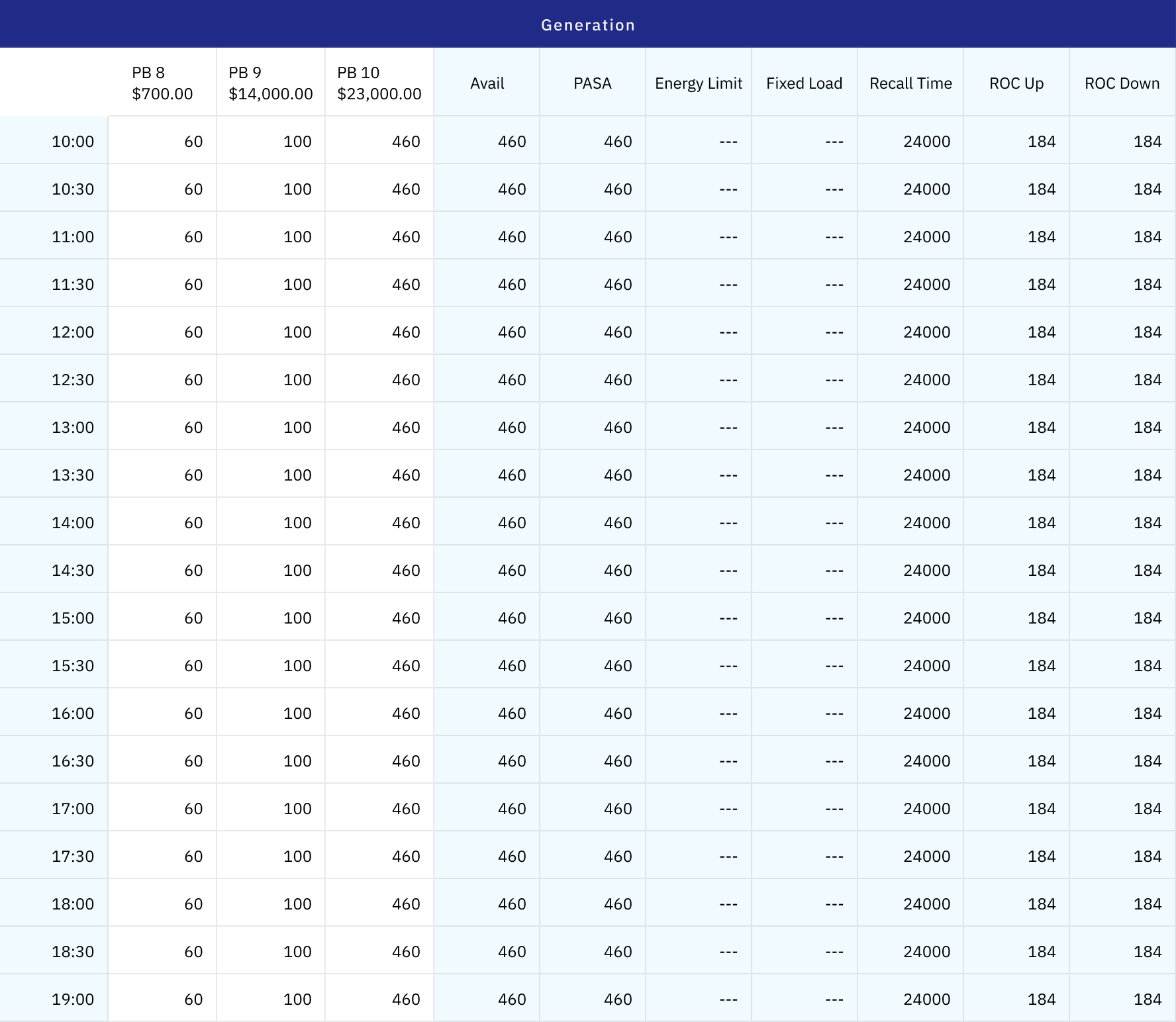

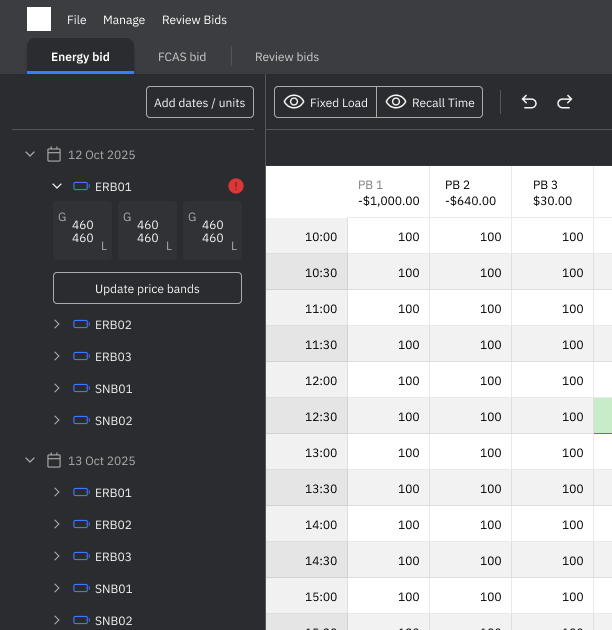

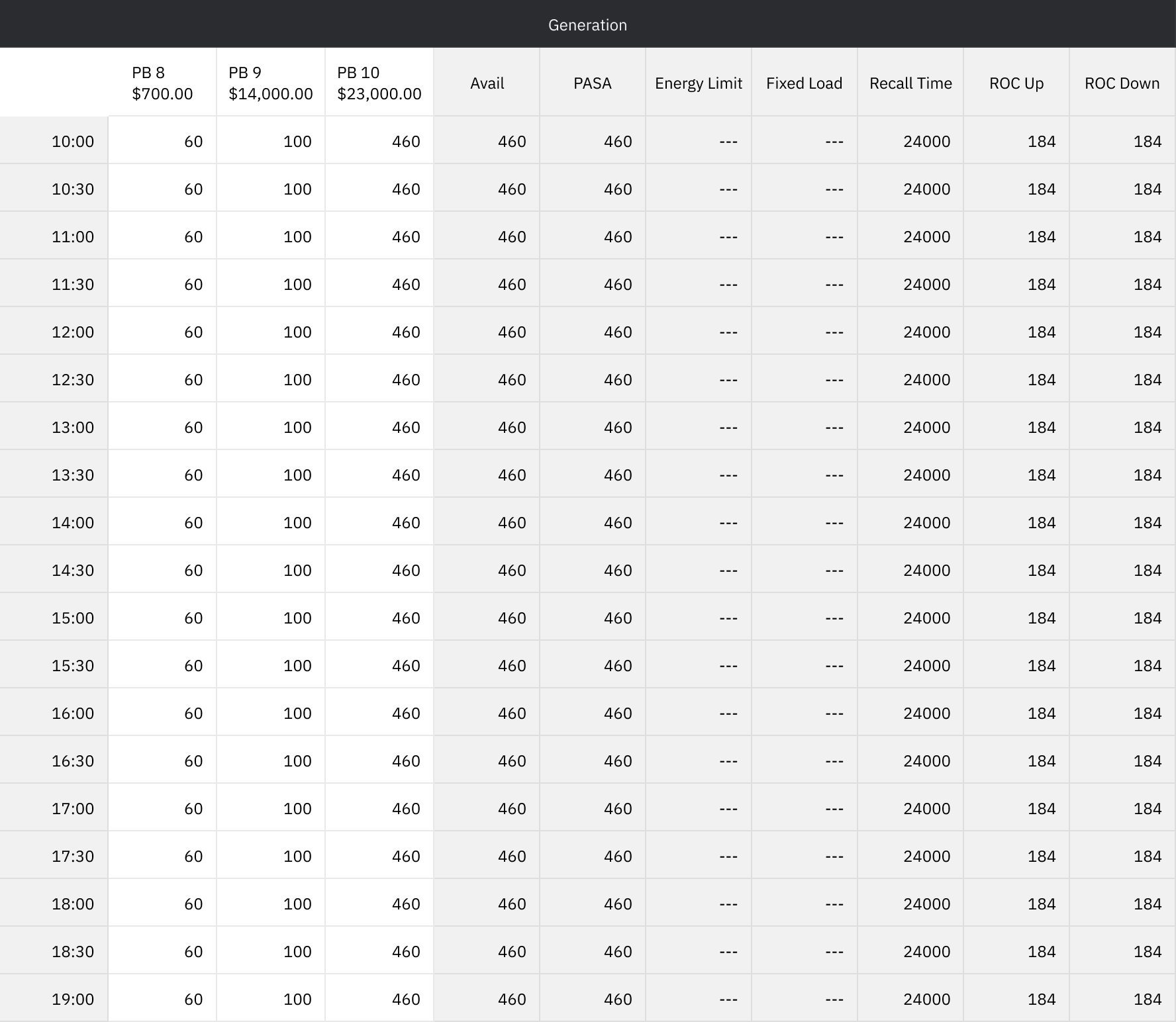

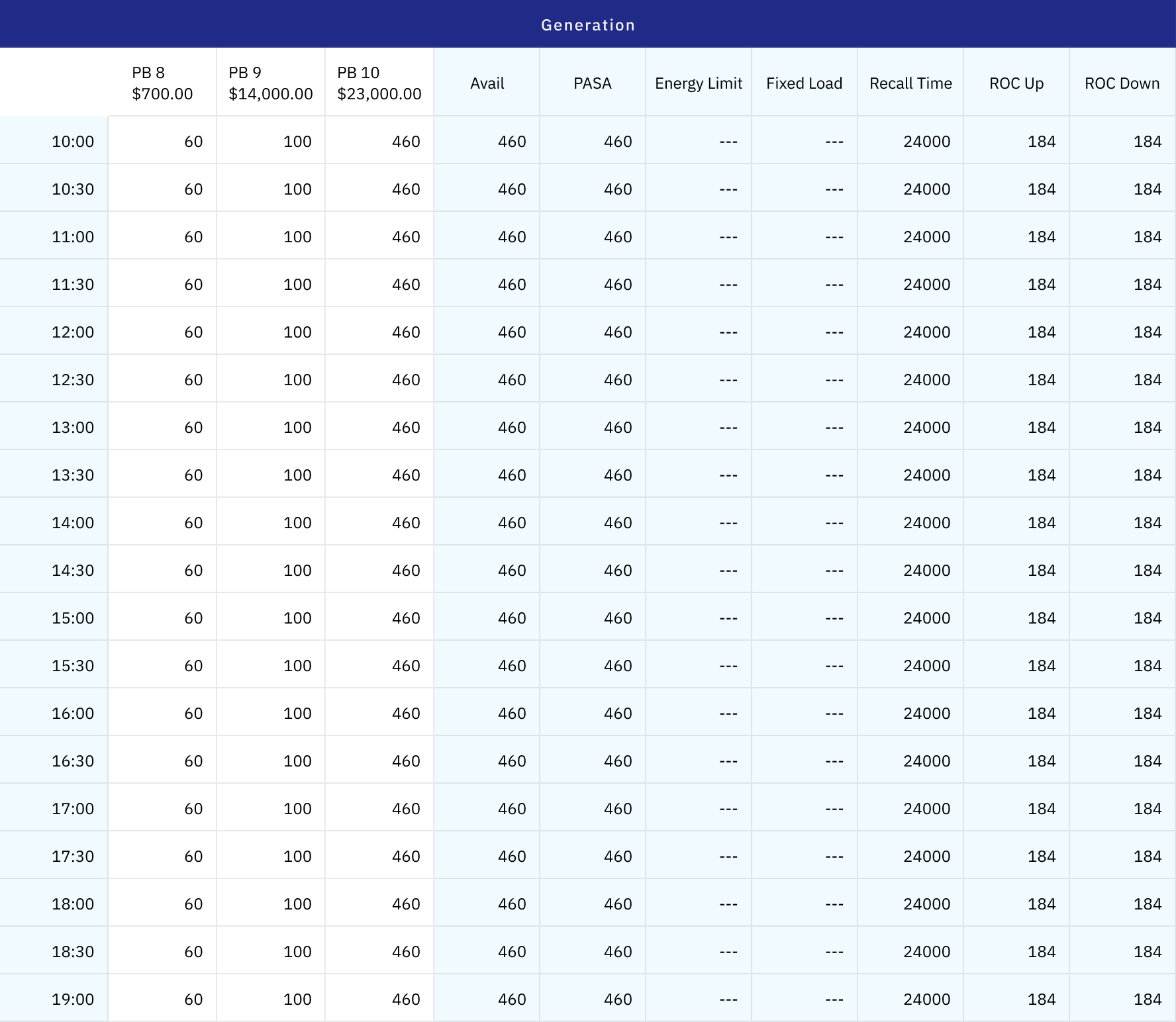

Dynamic battery bid grid A responsive, purpose-built grid for battery bidding across load and generation. It supports real-time validation, and is optimised for night use, high data density, and fast scanning patterns.

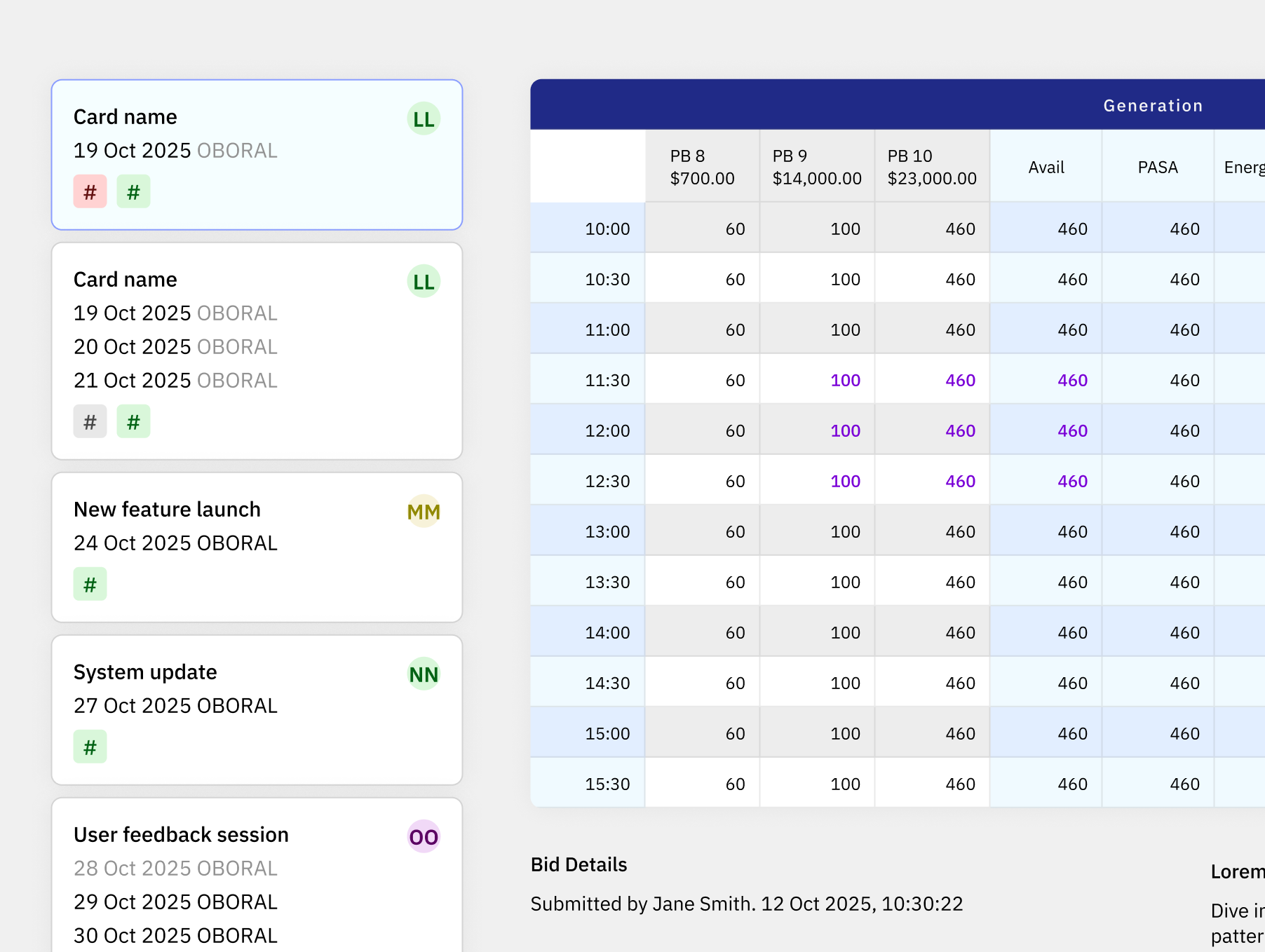

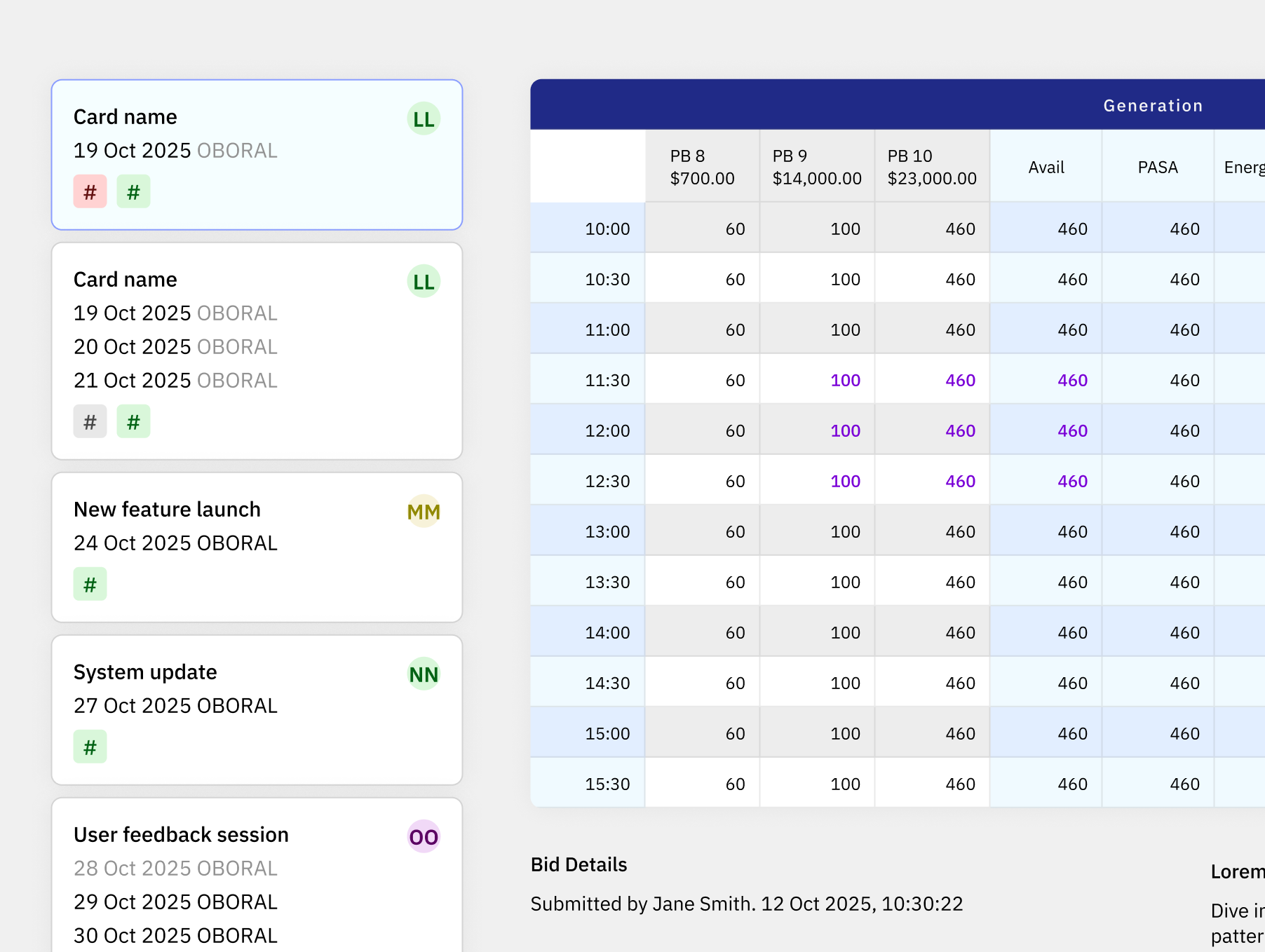

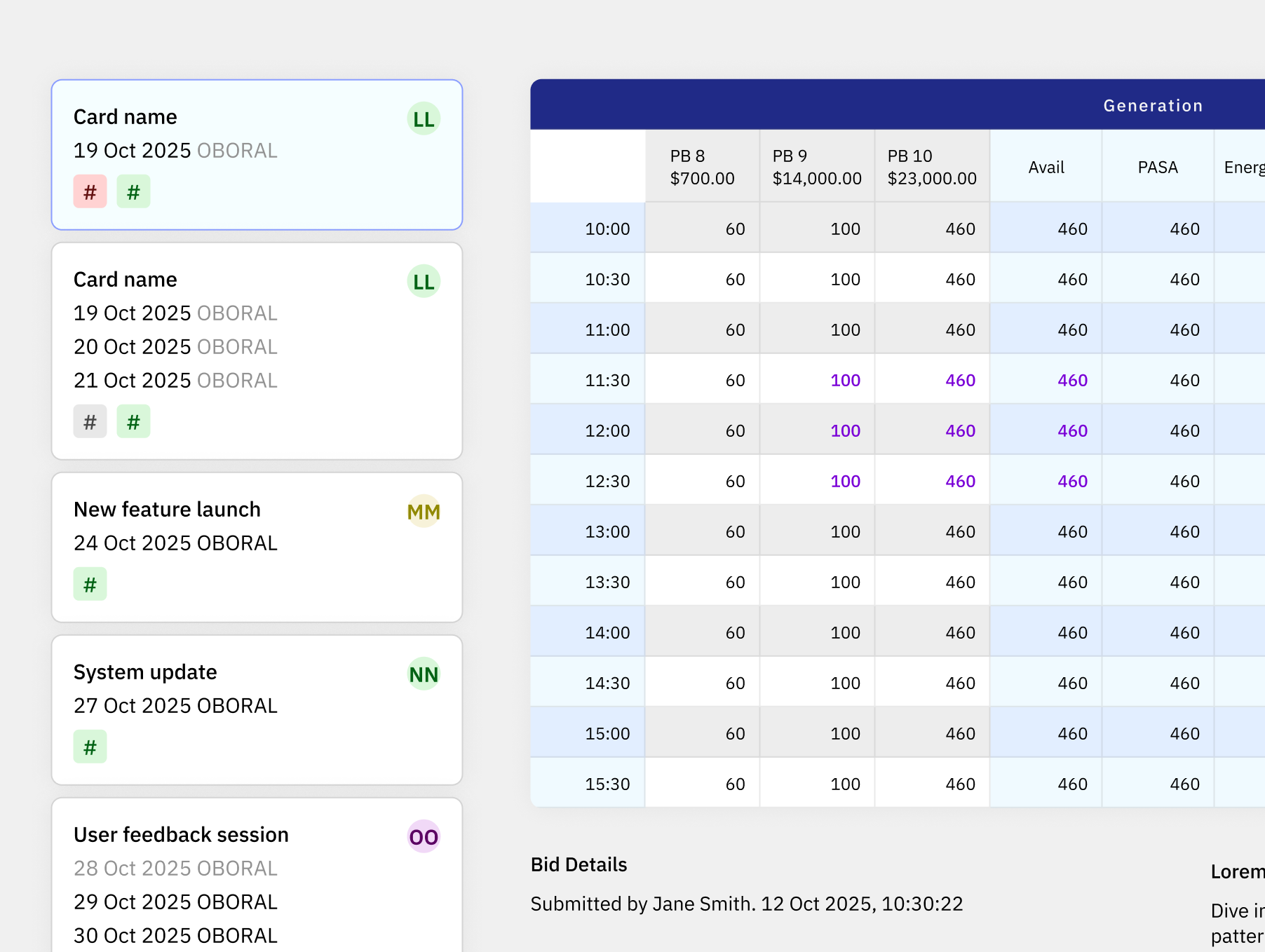

Put-everything-in-the-basket Action BarStreamlined process consolidates multiple dates and units into one view, aligning with their holistic strategy approach and minimising the need for constant context switching.

Dynamic bid adjustmentsA major workflow upgrade. Traders can dynamically adjust scope mid-bid without restarting the process — a limitation of the legacy system that caused major time losses in a 5-minute market.

Post-submission bid grid previewAfter submission, traders and compliance managers can view the exact grid that was submitted — something that previously didn’t exist. This builds confidence, supports troubleshooting, and dramatically improves compliance review.

Goals & Success

Interviews conducted with stakeholder groups revealed there were conflicting goals.

Wholesale technology goals

Facilitate compliant bidding within deadlines

Enable integration of future assets

Establish a robust foundation for future expansion

User goals

Enable traders to bid batteries intuitively and efficiently

Balance simplicity with regulatory compliance

Empower rapid decision-making

Research & Insights

I was hands on with the trading team, delving deep via:

Interviews with stakeholders across all levels

Immersion in trading activities to understand real-time decision-making under pressure

Continuous feedback loops and iteration cycles

Patterns, behaviours, pain points:

The trading floor is hectic; filled with visuals, sound, and lots of numbers

12-hour night and day shifts causes fatigue and highlights the need for clear interfaces

Interaction designs must enable quick decisions while minimising errors

Key insights from live trading immersion:

Lots of data = something’s got to give

Simplification is not enough; design must prioritise relevant data delivery

Interfaces should enhance their expertise rather than obstruct it

Strategy & Vision

Design principles for Kookaburra

1

Surface critical data at the right time

2

Minimise cognitive load without losing necessary detail

3

Support expert users while remaining usable under fatigue

These principles anchored the product in clarity, speed, and trust—essential in high-risk, compliance-heavy trading environments.

My plan...

String together an end-to-end bidding flow and prove Kookaburra can submit a valid bid to AEMO. Once complete, move onto efficiency improvements.

Things to consider

- Design for multi-screen environments

- Design for scale

- Design for the skills and resources available

- Design for compliance

Exploration

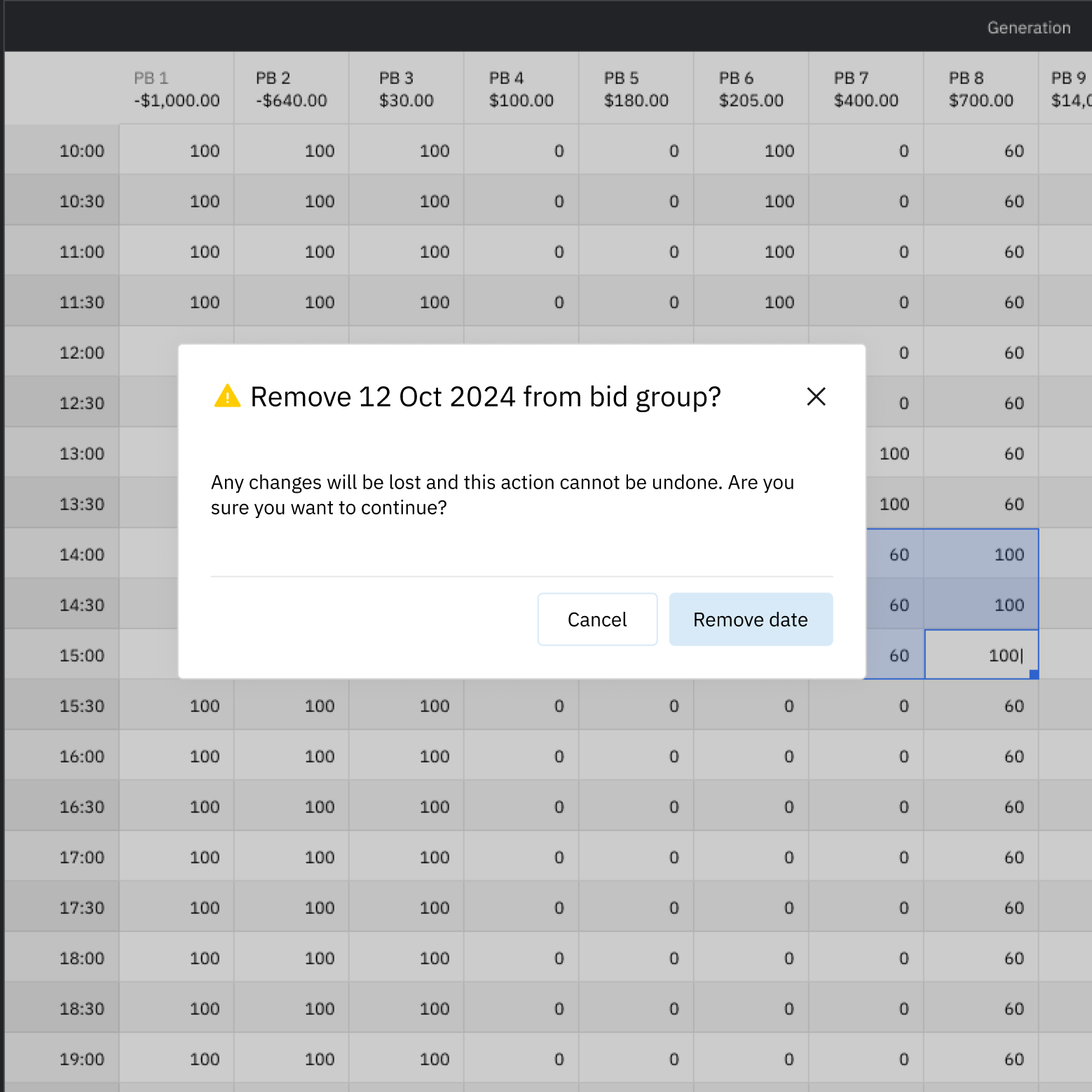

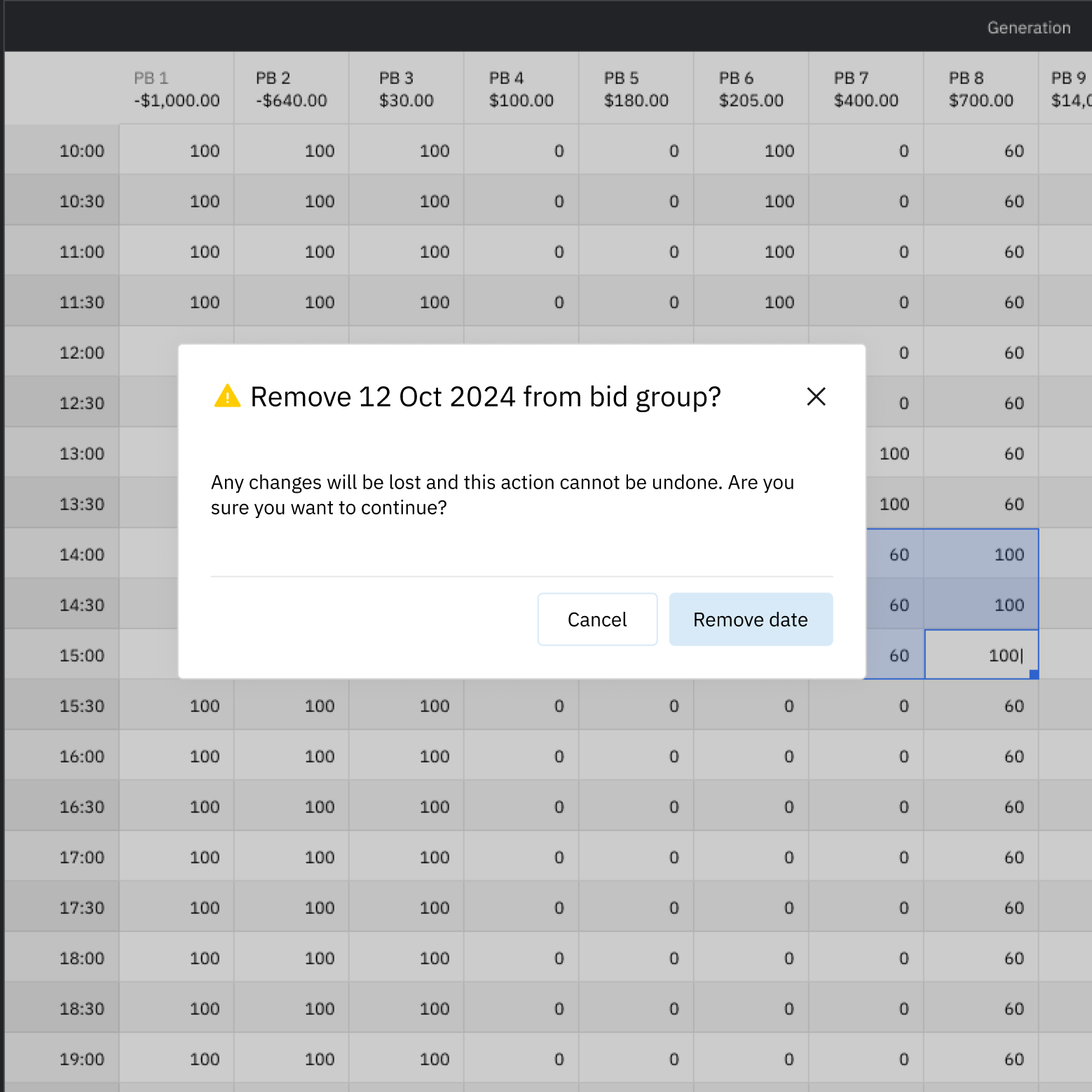

Bid grid: iteration 1. Low fidelity mock-up.

Bid grid: iteration 2. Initial data separation leveraging basic colour.

Bid grid: iteration 3. Higher contrast for night trading.

The bid grid as the heart of the experience

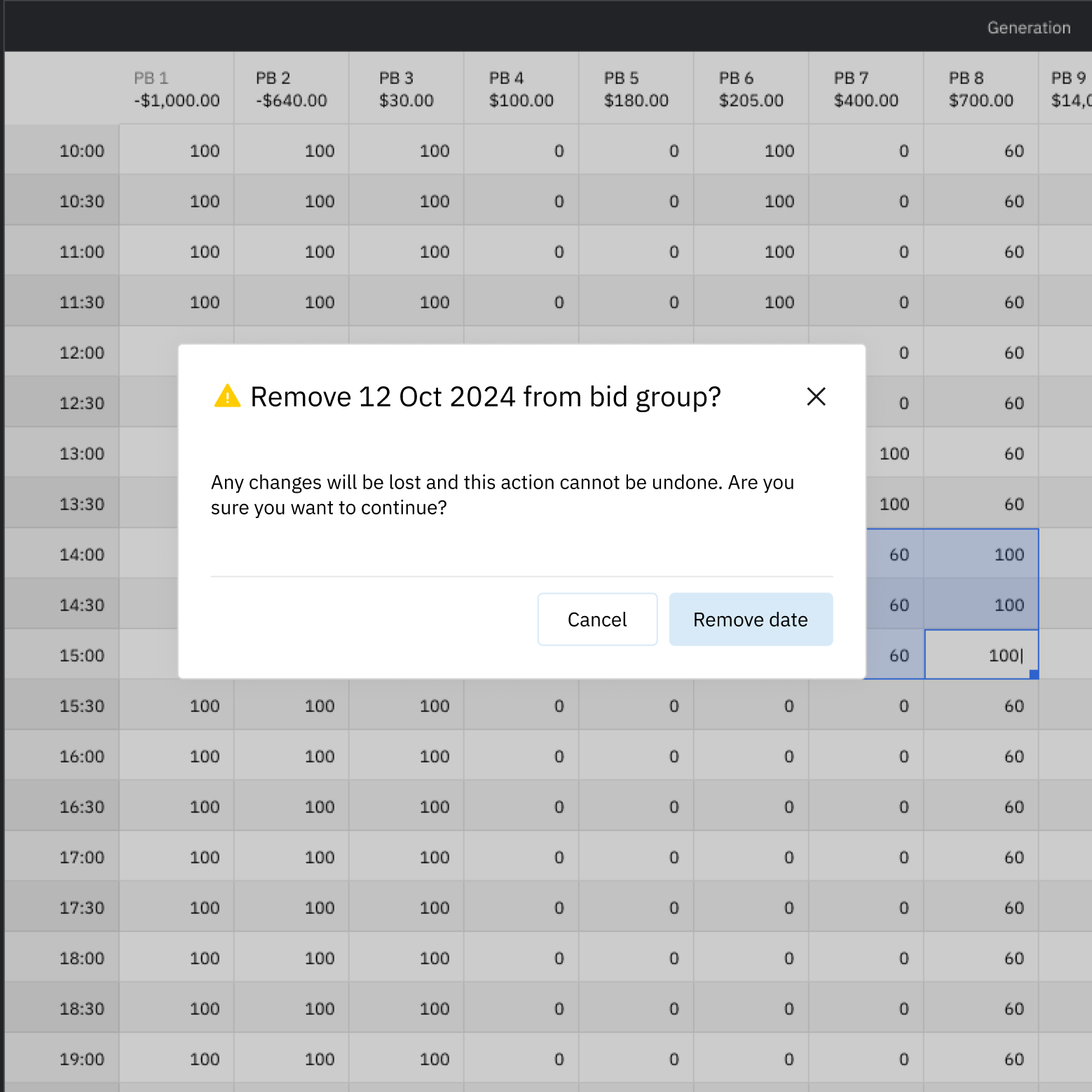

The bid grid underwent several iterations, with extensive experimentation on its architecture and visual design. It functions as a live form, validating inputs in real-time. With over 40 columns and 288 rows, there are numerous validation paths to navigate, requiring careful balancing of variants.

During this process, I consistently questioned assumptions—both mine and those of the traders. While traders often wanted more on-screen information for reassurance, co-design revealed that by the bidding stage, they had already established their strategy. Extra data added noise rather than value. The final design focused on the essential data needed at that moment, rather than everything they could potentially reference.

Trade-offsThe bid grid itself was a high-stakes design challenge. Built on AG Grid, performance was fragile—every additional feature, customisation, or interaction risked slowing the grid, which was unacceptable in 5-minute settlement markets. Error handling required custom logic, and form validation needed to be both robust and deeply integrated into the UX.

I collaborated closely with engineering to determine which interactions were feasible without compromising performance. For example, instead of the legacy system’s large expanding error panel, I redesigned the validation model so errors surfaced dynamically at the cell level, with hover interactions revealing details. This reduced noise while keeping error resolution fast and localised.

The engineering reality—one front-end developer with limited modern UI experience—required pragmatic prioritisation. I focused attention on the most critical, trader-facing interactions, while intentionally simplifying lower-impact UI components. These compromises ensured the product delivered the highest value where traders needed it most.

See other featured projects 2

Lisa Ly,

Senior Product Designer

This portfolio is mobile-friendly and handcrafted in Figma sites.

Lisa Ly,

Senior Product Designer

Home

Kookaburra

Electricity trading application optimised for large scale battery bidding.

Client

Origin Energy

Services

Systems

Strategy

Research

Industries

Energy Markets

Role

Lead Product Designer

Team Makeup

1 x Delivery Manager, 3 x Analysts, 5 x Developers, 2 x Testers, 1 x Designer

Date

April 2024 - Ongoing

Project has been renamed and images reproduced for privacy reasons.

Context & Problem

Origin Energy is expanding its renewable energy portfolio and identified the need for a new trading platform. It must be trader-centric in design and optimised to bid batteries into the market.

As the first design hire in Wholesale, I led the design strategy whilst highlighting design's critical role in internal wholesale projects.

Users & Environment

Key users consist of spot traders and strategy traders. With trading and compliance management as secondary users.

Traders currently navigate fast-paced, high-stakes markets characterised by unpredictability and swift settlements. Continuous focus on complex data make compliant bidding difficult.

Example of trading desk. Source: Google

Final design

The final design brings together speed, clarity, and trader-centred decision making. The (ever-evolving) solution balances familiar mental models with new capabilities that support Origin’s first-ever battery bidding operations.

Key features

Dynamic battery bid grid A responsive, purpose-built grid for battery bidding across load and generation. It supports real-time validation, and is optimised for night use, high data density, and fast scanning patterns.

Put-everything-in-the-basket Action BarStreamlined process consolidates multiple dates and units into one view, aligning with their holistic strategy approach and minimising the need for constant context switching.

Dynamic bid adjustmentsA major workflow upgrade. Traders can dynamically adjust scope mid-bid without restarting the process — a limitation of the legacy system that caused major time losses in a 5-minute market.

Post-submission bid grid previewAfter submission, traders and compliance managers can view the exact grid that was submitted — something that previously didn’t exist. This builds confidence, supports troubleshooting, and dramatically improves compliance review.

Goals & Success

Interviews conducted with stakeholder groups revealed there were conflicting goals.

Wholesale technology goals

Facilitate compliant bidding within deadlines

Enable integration of future assets

Establish a robust foundation for future expansion

User goals

Enable traders to bid batteries intuitively and efficiently

Balance simplicity with regulatory compliance

Empower rapid decision-making

Research & Insights

I was hands on with the trading team, delving deep via:

Interviews with stakeholders across all levels

Immersion in trading activities to understand real-time decision-making under pressure

Continuous feedback loops and iteration cycles

Patterns, behaviours, pain points:

The trading floor is hectic; filled with visuals, sound, and lots of numbers

12-hour night and day shifts causes fatigue and highlights the need for clear interfaces

Interaction designs must enable quick decisions while minimising errors

Key insights from live trading immersion:

Lots of data = something’s got to give

Simplification is not enough; design must prioritise relevant data delivery

Interfaces should enhance their expertise rather than obstruct it

Strategy & Vision

Design principles for Kookaburra

These principles anchored the product in clarity, speed, and trust—essential in high-risk, compliance-heavy trading environments.

My plan...

String together an end-to-end bidding flow and prove Kookaburra can submit a valid bid to AEMO. Once complete, move onto efficiency improvements.

Things to consider

- Design for multi-screen environments

- Design for scale

- Design for the skills and resources available

- Design for compliance

1

Surface critical data at the right time

2

Minimise cognitive load without losing necessary detail

3

Support expert users while remaining usable under fatigue

Exploration

Bid grid: iteration 1. Low fidelity mock-up.

Bid grid: iteration 2. Initial data separation leveraging basic colour.

Bid grid: iteration 3. Higher contrast for night trading.

The bid grid as the heart of the experience

The bid grid underwent several iterations, with extensive experimentation on its architecture and visual design. It functions as a live form, validating inputs in real-time. With over 40 columns and 288 rows, there are numerous validation paths to navigate, requiring careful balancing of variants.

During this process, I consistently questioned assumptions—both mine and those of the traders. While traders often wanted more on-screen information for reassurance, co-design revealed that by the bidding stage, they had already established their strategy. Extra data added noise rather than value. The final design focused on the essential data needed at that moment, rather than everything they could potentially reference.

Trade-offsThe bid grid itself was a high-stakes design challenge. Built on AG Grid, performance was fragile—every additional feature, customisation, or interaction risked slowing the grid, which was unacceptable in 5-minute settlement markets. Error handling required custom logic, and form validation needed to be both robust and deeply integrated into the UX.

I collaborated closely with engineering to determine which interactions were feasible without compromising performance. For example, instead of the legacy system’s large expanding error panel, I redesigned the validation model so errors surfaced dynamically at the cell level, with hover interactions revealing details. This reduced noise while keeping error resolution fast and localised.

The engineering reality—one front-end developer with limited modern UI experience—required pragmatic prioritisation. I focused attention on the most critical, trader-facing interactions, while intentionally simplifying lower-impact UI components. These compromises ensured the product delivered the highest value where traders needed it most.

See other featured projects 2

Lisa Ly,

Senior Product Designer

This portfolio is mobile-friendly and handcrafted in Figma sites.

Lisa Ly,

Senior Product Designer

Home

Kookaburra

Electricity trading application optimised for large scale battery bidding.

Client

Origin Energy

Services

Systems

Strategy

Research

Industries

Energy Markets

Role

Lead Product Designer

Team Makeup

1 x Delivery Manager, 3 x Analysts, 5 x Developers, 2 x Testers, 1 x Designer

Date

April 2024 - Ongoing

Project has been renamed and images reproduced for privacy purposes.

Context & Problem

Origin Energy is expanding its renewable energy portfolio and identified the need for a new trading platform. It must be trader-centric in design and optimised to bid batteries into the market.

As the first design hire in Wholesale, I led the design strategy whilst highlighting design's critical role in internal wholesale projects.

Users & Environment

Key users consist of spot traders and strategy traders. With trading and compliance management as secondary users.

Traders currently navigate fast-paced, high-stakes markets characterised by unpredictability and swift settlements. Continuous focus on complex data make compliant bidding difficult.

Example of trading desk. Source: Google

Final design

The final design brings together speed, clarity, and trader-centred decision making. The (ever-evolving) solution balances familiar mental models with new capabilities that support Origin’s first-ever battery bidding operations.

Key features

Dynamic battery bid gridA responsive, purpose-built grid for battery bidding across load and generation. It supports real-time validation, and is optimised for night use, high data density, and fast scanning patterns.

Put-everything-in-the-basket Action BarStreamlined process consolidates multiple dates and units into one view, aligning with their holistic strategy approach and minimising the need for constant context switching.

Dynamic bid adjustmentsA major workflow upgrade. Traders can dynamically adjust scope mid-bid without restarting the process — a limitation of the legacy system that caused major time losses in a 5-minute market.

Post-submission bid grid previewAfter submission, traders and compliance managers can view the exact grid that was submitted — something that previously didn’t exist. This builds confidence, supports troubleshooting, and dramatically improves compliance review.

Goals & Success

Interviews conducted with stakeholder groups revealed there were conflicting goals.

Wholesale technology goals

Facilitate compliant bidding within deadlines

Enable integration of future assets

Establish a robust foundation for future expansion

Trading goals

Enable traders to bid batteries intuitively and efficiently

Balance simplicity with regulatory compliance

Empower rapid decision-making

Research & Insights

I was hands on with the trading team, delving deep via:

Interviews with stakeholders across all levels

Immersion in trading activities to understand real-time decision-making under pressure

Continuous feedback loops and iteration cycles

Patterns, behaviours, pain points:

The trading floor is hectic; filled with visuals, sound, and lots of numbers

12-hour night and day shifts causes fatigue and highlights the need for clear interfaces

Interaction designs must enable quick decisions while minimising errors

Key insights from live trading immersion:

Lots of data = something’s got to give

Simplification is not enough; design must prioritise relevant data delivery

Interfaces should enhance their expertise rather than obstruct it

Strategy & Vision

Design principles for Kookaburra

These principles anchored the product in clarity, speed, and trust—essential in high-risk, compliance-heavy trading environments.

My plan...

String together an end-to-end bidding flow and prove Kookaburra can submit a valid bid to AEMO. Once complete, move onto efficiency improvements.

Things to consider

- Design for multi-screen environments

- Design for scale

- Design for the skills and resources available

- Design for compliance

1

Surface critical data at the right time

2

Minimise cognitive load without losing necessary detail

3

Support expert users while remaining usable under fatigue

Exploration

Bid grid: iteration 1. Low fidelity mock-up.

Bid grid: iteration 2. Initial data separation leveraging basic colour.

Bid grid: iteration 3. Higher contrast for night trading. Clear validation signals to support immediate remediation.

The bid grid as the heart of the experience

The bid grid underwent several iterations, with extensive experimentation on its architecture and visual design. It functions as a live form, validating inputs in real-time. With over 40 columns and 288 rows, there are numerous validation paths to navigate, requiring careful balancing of variants.

During this process, I consistently questioned assumptions—both mine and those of the traders. While traders often wanted more on-screen information for reassurance, co-design revealed that by the bidding stage, they had already established their strategy. Extra data added noise rather than value. The final design focused on the essential data needed at that moment, rather than everything they could potentially reference.

Trade-offsThe bid grid itself was a high-stakes design challenge. Built on AG Grid, performance was fragile—every additional feature, customisation, or interaction risked slowing the grid, which was unacceptable in 5-minute settlement markets. Error handling required custom logic, and form validation needed to be both robust and deeply integrated into the UX.

I collaborated closely with engineering to determine which interactions were feasible without compromising performance. For example, instead of the legacy system’s large expanding error panel, I redesigned the validation model so errors surfaced dynamically at the cell level, with hover interactions revealing details. This reduced noise while keeping error resolution fast and localised.

The engineering reality—one front-end developer with limited modern UI experience—required pragmatic prioritisation. I focused attention on the most critical, trader-facing interactions, while intentionally simplifying lower-impact UI components. These compromises ensured the product delivered the highest value where traders needed it most.

Other featured projects 2

Lisa Ly,

Senior Product Designer

This portfolio is mobile-friendly and handcrafted in Figma sites.